Personal finance can seem overwhelming, but it doesn't have to be. By implementing sound financial habits, you can attain your financial aspirations. This guide will offer website you with the essential knowledge to handle your money effectively.

First and foremost, establish a budget. This involves tracking your income and expenses to get a clear picture of your financial position. Once you have a reliable grasp of where your money is going, you can identify areas where you can minimize spending and direct more funds to savings and properties.

Moreover, it's crucial to establish an emergency fund. This safety net can help you navigate unexpected outlays without jeopardizing your financial well-being. Aim to have six months' worth of living expenditures in a readily liquid account.

Finally, don't neglect the importance of growing your money.

Unlocking Growth: A Beginner's Introduction to Mutual Funds

Mutual funds provide a fantastic way for individuals to allocate their investments and likely achieve their investment goals. A mutual fund is a basket of securities, such as stocks, bonds, or assets, managed by a professional investment expert.

By allocating in a mutual fund, you gain exposure to a wide-ranging portfolio of assets without having to analyze each one separately. This expedites the wealth building process and allows even newcomers to involve in the financial markets.

Mutual funds come in a spectrum of types, each with its own return potential. Some popular examples include:

* {Equity funds|: Funds that primarily invest in stocks, aiming for capital appreciation.

* {Bond funds|: Funds that focus on investing in bonds, seeking income.

* {Index funds|: Funds that mirror a specific market index, such as the S&P 500.

Beforehand you put money in any mutual fund, it's important to grasp its objectives, risks, and expenses.

Building Wealth for Tomorrow

Achieving a stable future hinges on sound financial planning. This involves a comprehensive analysis of your present financial position, setting achievable goals, and implementing a structured plan to reach those objectives. By carefully managing your revenue, expenses, and holdings, you can position yourself for financial well-being in the years to come.

- Evaluate your appetite for risk

- Allocate your investments

- Assess your progress regularly

Building Wealth Through Savvy Investment

Wealth building is a journey that often involves making well-informed decisions about how to manage your finances. A key aspect of this journey is strategic investment. By allocating your funds wisely, you can position yourself for long-term growth and create a solid financial foundation.

There are different investment options available, each with its own set of risks and rewards. You should always consider factors like your investment goals when making decisions about where to allocate your money.

Diversification your investments across different asset classes can help mitigate risk and improve your overall returns. It's also crucial to perform thorough research before putting any funds. Staying current about market trends and economic conditions can help you make more prudent investment choices.

Navigating Market Volatility: Tips for Prudent Investing

Market volatility can discourage even the most seasoned investors. Nevertheless, understanding why these fluctuations and utilizing a prudent method can help you to not only weather these kinds of storms but also potentially exploit them.

One important step is to diversify your investments across various asset classes, such as stocks, bonds, and real estate. This helps the impact of any single market performing poorly.

Furthermore, it's important to have a strategic investment plan which aligns with your financial goals. Stay away from making impulsive actions based on fleeting market movements.

Remember to periodically assess your portfolio and make adjustments according to circumstances. Maintaining informed about market trends and economic conditions can also prove you in making more informed investment choices.

Tailor Your Portfolio: Choosing the Right Mutual Funds

Building a well-structured investment portfolio necessitates a acute eye for detail. Mutual funds, these pool money from multiple investors to allocate to a broad range of assets, can be valuable assets in this endeavor. However, navigating the extensive selection of mutual funds available can feel challenging. To maximize your portfolio's performance, it's essential to meticulously select the right funds.

- Assess Your Investment Objectives: Are you seeking long-term growth, consistent income, or a combination of both?

- Identify Your Tolerance: How much volatility are you willing to in your portfolio?

- Analyze Different Mutual Fund Categories: Explore equity funds, bond funds, balanced funds, and sector-specific funds to align with your needs.

Scrutinize a Fund's History: Look at its yields over different time periods and contrast it to its standards. Remember that past performance is not always an indication of future results.

Consult with a Investment Professional: A qualified advisor can provide personalized guidance based on your specific circumstances.

Amanda Bynes Then & Now!

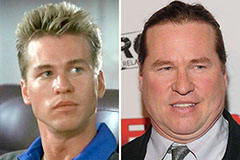

Amanda Bynes Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!